Bank of America Business Credit Card Apply

इस पोस्ट में क्या है ?

Bank of America Business Credit Card : Bank of America offers a variety of business credit cards designed to meet the needs of small business owners, entrepreneurs, and large corporations alike. These cards come with a range of features, benefits, and rewards tailored to help businesses manage expenses, improve cash flow, and earn rewards on everyday purchases. Below is a detailed overview of Bank of America’s business credit card offerings, including their features, benefits, and how to choose the right card for your business.

Types of Bank of America Business Credit Cards

1. Bank of America® Business Advantage Customized Cash Rewards Credit Card*

– Best for: Businesses looking for flexible cash back rewards.

– Rewards: Earn 3% cash back in the category of your choice (gas stations, office supply stores, travel, TV/telecom & wireless, computer services, or business consulting services), 2% cash back on dining, and 1% cash back on all other purchases.

– Bonus Offer: $300 statement credit bonus after spending $3,000 in the first 90 days.

– Annual Fee: $0.

– Additional Benefits: Free employee cards, expense management tools, and fraud protection.

2. Bank of America® Business Advantage Travel Rewards World Mastercard® Credit Card

– Best for: Businesses that frequently travel.

– Rewards: Earn unlimited 1.5 points per dollar on all purchases.

– Bonus Offer: 30,000 bonus points after spending $3,000 in the first 90 days.

– Annual Fee: $0.

– Additional Benefits: No foreign transaction fees, travel insurance, and flexible redemption options for flights, hotels, and car rentals.

How to Get Your $200 Cash Rewards from Bank of America

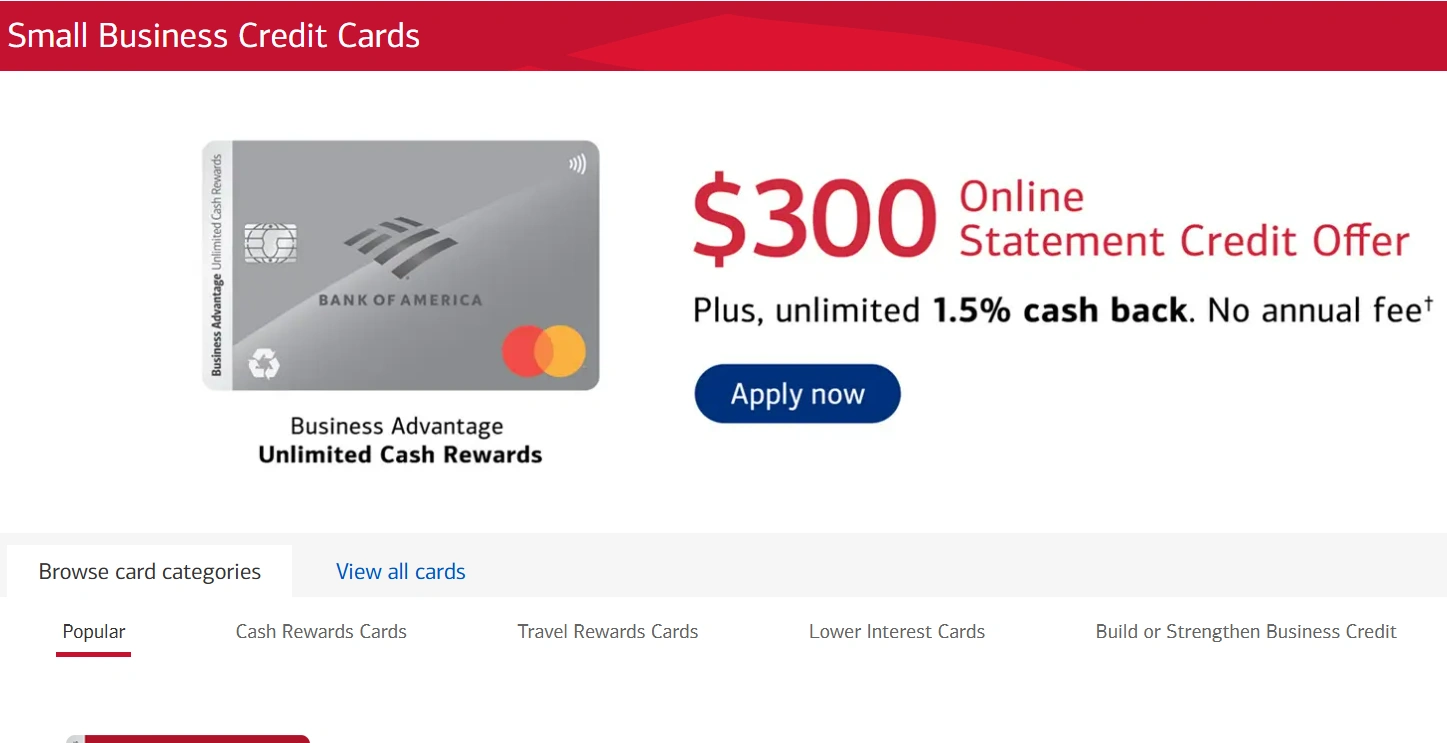

3. Bank of America® Business Advantage Unlimited Cash Rewards Mastercard® Credit Card

– Best for: Businesses seeking simple, unlimited cash back.

– Rewards: Earn unlimited 1.5% cash back on all purchases.

– Bonus Offer: $300 statement credit bonus after spending $3,000 in the first 90 days.

– Annual Fee: $0.

– Additional Benefits: Free employee cards, expense management tools, and fraud protection.

Capital One Venture X Rewards Credit Card Review : Apply Online, Eligibility, Benefits and Fees

4. Bank of America® Platinum Plus® Mastercard® Business Credit Card

– Best for: Businesses looking for a straightforward credit card with no annual fee.

– Rewards: No rewards program, but offers a low introductory APR on purchases and balance transfers.

– Annual Fee: $0.

– Additional Benefits: Free employee cards, expense management tools, and fraud protection.

Key Features and Benefits

1. Rewards and Cash Back

– Bank of America business credit cards offer competitive rewards programs, including cash back, travel points, and customizable rewards categories. These rewards can help businesses save money on everyday expenses or fund future travel.

2. Sign-Up Bonuses

– Many Bank of America business credit cards come with attractive sign-up bonuses, such as statement credits or bonus points, which can provide immediate value to new cardholders.

3. No Annual Fee

– Most Bank of America business credit cards have no annual fee, making them a cost-effective option for businesses of all sizes.

4. Expense Management Tools

– Bank of America provides robust expense management tools, including online and mobile account access, spending reports, and the ability to set spending limits on employee cards.

5. Employee Cards

– Business owners can issue free employee cards, making it easy to manage team expenses while earning rewards on employee purchases.

6. Fraud Protection

– Bank of America offers advanced fraud protection features, including $0 liability for unauthorized transactions and real-time fraud monitoring.

7. Travel Benefits

– Travel-focused cards come with perks such as no foreign transaction fees, travel insurance, and flexible redemption options for flights, hotels, and car rentals.

How to Choose the Right Card

When selecting a Bank of America business credit card, consider the following factors:

– Spending Habits: Choose a card that aligns with your business’s spending patterns. For example, if you spend heavily on travel, the Business Advantage Travel Rewards card may be the best fit.

– Rewards Preferences: Decide whether you prefer cash back, travel rewards, or customizable rewards categories.

– Fees: Most Bank of America business credit cards have no annual fee, but it’s important to review other fees, such as foreign transaction fees or late payment fees.

– Bonus Offers: Take advantage of sign-up bonuses to maximize the value of your card.

How to Bank of America Business Credit Card Apply

To apply for a Bank of America business credit card, visit the Bank of America website or a local branch. You’ll need to provide information about your business, including:

– Business name and address

– Tax identification number (TIN)

– Annual revenue

– Years in business

– Personal information for the primary cardholder

Conclusion

Bank of America business credit cards offer a variety of options to suit different business needs, from cash back and travel rewards to simple, no-frills credit cards. With no annual fees, robust expense management tools, and attractive sign-up bonuses, these cards can help businesses save money, streamline expenses, and earn rewards on everyday purchases. By carefully evaluating your business’s spending habits and rewards preferences, you can choose the right card to support your financial goals. Source Link